Why Stocks Often Trade Under Their NAV

Last week, on an interview with the Interactive Investor, Pershing Square’s (NYSE:PSH) Bill Ackman commented that PSH was trading at a 30% discount to net asset value (NAV). He stated that ‘We (Pershing Square) own some of the highest quality businesses in the world, and you can buy them at a 30% discount.. by buying them through us (PSH)’. Ackman’s statements pose an interesting question, as to why certain funds, both passive and active trade below their NAVs in public markets.

Close Ended Funds

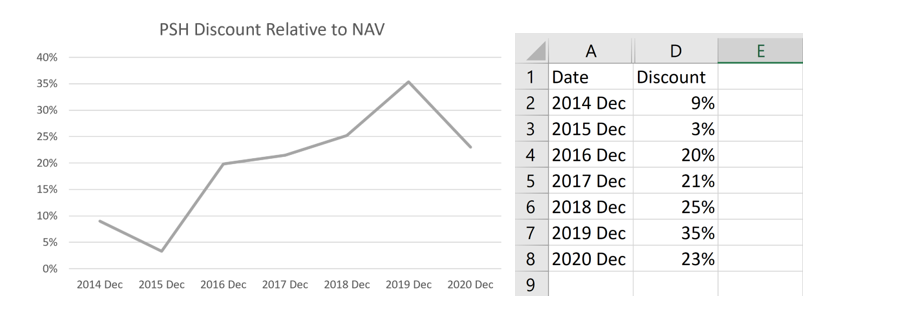

Raw data obtained from Pershing Square

Investment forums often recommend that investors purchase ‘discounted’ securities, and that they sell these securities at a premium (to NAV). This however, does not apply to the securities where such advice would be most apt – namely closed end funds (CEF), which usually post their NAVs on a weekly basis. This is due to the phenomena of persistent discounts, which as the name suggests is a constant percentage that securities, typically CEFs, are discounted at.

Persistent discounts to NAV isn’t something unique to PSH, rather it’s a common trait found in most close-ended funds. This is mainly due to structuring complexity both within the CEF itself and its holdings, debt, taxes, investments in derivatives, compensation structures, name-value of portfolio managers and market volatility. It is however interesting to note that this discount has seemed widen over time in the case of PSH, which could be attributed to its negative performances, due to JC Penny, its Herbalife short, and of course Valeant Pharmaceuticals. It is plausible that the gap shrank due to market perceptions after three years of solid hedges and returns.

Passive Funds (ETFs & REITs)

Expectedly, passive funds which are often devoid of the complexity and volatility surrounding CEFs, tend to lack persistent discounts.

Raw data obtained from SSGA

Take for example the SPY, which tracks the S&P 500. As seen in the graph above, the index does not suffer from persistent discounting. Instead, it gyrates from being sold at a premium and being sold at a discount. Hence similar to our previous article, where we explored how ETF inefficiencies can be exploited, similar gains can be made by buying at a discount and selling at a premium.

Interestingly, REITs, which are made up of the most tangible assets short of commodities, also seem to suffer from being sold at a discount to NAV.

Source: S&P Global

As seen in this report by S&P Global, REITs, especially those that compromise malls, and office spaces are heavily discounted. Industrial and healthcare spaces on the other hand are priced at a premium to NAV. This in reality is a knock-on effect of ‘pricing in’. The pandemic rapidly accelerated trends such as the increased utilization of online shopping and flexible working arrangements. REITs like the Washington Prime Group (delisted, NYSE:WPG) have been impacted so badly by the pandemic that they are forced to file for bankruptcy. These fundamental changes seem to be long-term, and have significantly warped how investors perceive REITs. Hence leading to the vast majority of ‘traditional REITs being sold at discount.